With no shareholders to please, our profits are reinvested to benefit you.

Confirmation of Payee: A new service to help safeguard your payments is coming soon. Learn more.

At The Mutual Bank, we understand that every business is different. That’s why we offer a range of business transaction accounts designed to support your day-to-day operations, whether you're managing cash flow, handling client funds or looking to streamline your financial processes.

Our accounts provide the flexibility, features and support your business needs to thrive. With easy access to your funds, secure digital banking and options to suit businesses of all sizes, we’re here to help you stay focused on what matters most: growing your business.

We offer a range of trust account options for professionals who are required to manage client funds under regulatory obligations. Whether you're a solicitor, licensed conveyancer or estate agent, we can help you meet your compliance requirements with dedicated trust account solutions and personalised support.

Looking for a business account to manage day to day transactions and earn interest? Talk to us about our Business Maximiser account to benefit from earning interest with flexible and convenient access to funds.

The Mutual Bank’s Business Cheque Account is our best value at-call account for business’s looking for fuss-free banking solutions.

Our business accounts are available to a wide range of entities, including sole traders, partnerships, companies, trusts, associations, and not-for-profits. Some accounts, such as trust accounts, are designed for specific industries like legal, real estate, or conveyancing services.

Most of our business accounts do not require a minimum opening balance. However, interest-earning accounts like the Business Maximiser or Internet Saver Business may have balance thresholds to qualify for interest.

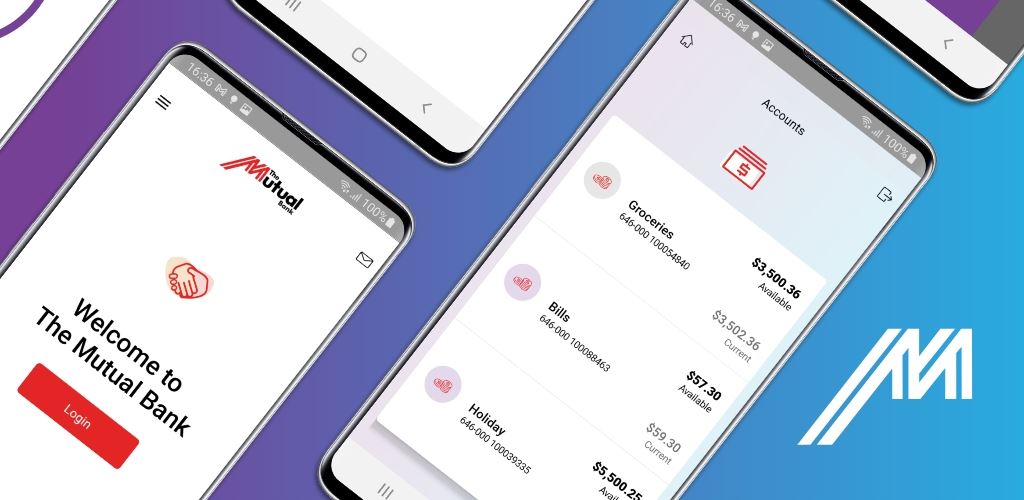

Yes. All business accounts can be accessed through The Mutual App and Internet Banking, allowing you to view balances, transfer funds, pay bills, and download statements 24/7.

Yes. You can request a Mutual Visa Debit Card for eligible business accounts, such as the Business Maximiser or Business Cheque Account. This allows you to make purchases in-store, online or over the phone.

Yes. Our Business Maximiser, Internet Saver Business, and Farm Management Deposit accounts offer competitive interest on eligible balances. Interest is calculated daily and paid monthly or at maturity, depending on the account.

We’re proudly customer owned, which means we exist to benefit you. Not external shareholders. Whether you're opening your first account or planning for the future, we’re here with genuine service, great-value products and the kind of care only a mutual can offer.

View and compare our Business Savings Accounts

Interest is calculated by applying the daily percentage rate applicable to the daily balance as set out to the entire balance and paid 3 monthly on 31st March, 30th June, 30th September and 31st December. The daily percentage rate is the applicable annual percentage rate divided by 365. Penalty Interest will be charged at a rate of 20.00% per annum on overdrawn accounts. This penalty interest will be calculated daily and charged on a monthly basis.

We have not considered your objectives, financial situation, or needs. You should consider these things, along with the Product Disclosure Statement and our product Target Market Determinations before making any decision to acquire a product.

The daily percentage rate is the applicable annual percentage rate divided by 365.