With no shareholders to please, our profits are reinvested to benefit you.

Explore our Savings and Investment Accounts

Whether you're saving for a special event, planning a holiday, building your wealth or investing with confidence, we have an account to suit your needs.

Enjoy competitive interest rates, secure banking and features designed to help your money grow. Whatever your goal, make it yours sooner with one of our savings or investment accounts.

Enjoy flexible banking options and access to your funds with The Mutual Bank's Cash Management account.

-

Up toInterest rate0.05 %

Earn a higher rate of interest on your savings with a Term Deposit. A Term Deposit is a secure way to grow your savings with terms available from one month to three years

-

Up toInterest rate4.40 %

Our Internet Saver account allows you to earn interest while being able to access your funds at your convenience. Tiered interest rates apply.

-

Up toInterest rate2.25 %

Looking for a savings account that encourages good savings habits? The Mutual Bank’s Bonus Saver account allows you to earn interest if you make one deposit and no withdrawals in a calendar month.

-

Interest rate3.25 %

Mighty Mutual account, which offers bonus interest* for regular saving, is a great way to educate children on the importance of saving. Enjoy no coin handling fees, plus earn bonus interest for regular saving.

-

Up toInterest rate3.50 %

Christmas is a great time of the year - giving and receiving gifts, spending time with family and friends, maybe you are planning a holiday. Save a little each week and access your savings at the festive time of the year.

-

Up toInterest rate0.25 %

Why bank with us?

You're gonna love us

The Mutual Bank has been supporting regional communities with trusted banking for over 135 years

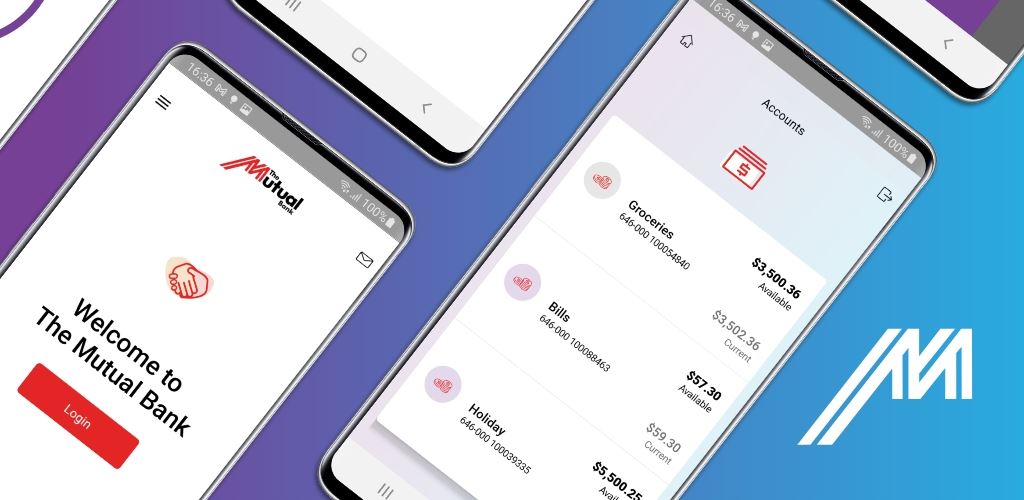

We’re proudly customer owned, which means we exist to benefit you. Not external shareholders. Whether you're opening your first account or planning for the future, we’re here with genuine service, great-value products and the kind of care only a mutual can offer.

Looking for something else?

View and compare our Transaction Accounts