Confirmation of Payee: A new service to help safeguard your payments is coming soon. Learn more.

Save on interest and make it yours sooner

Our 100% Loan Offset Account is a transaction account available with eligible variable rate home loans. Instead of earning interest, your account balance is offset against your loan balance reducing the interest you pay and helping you pay off your home loan faster. Plus, your money stays accessible whenever you need it.

Product Features:

Everyday Banking |

|

|---|---|

| Monthly fee : | $7.50 |

| Mutual Visa Debit Card : | Available |

| ATM/Eftpos access : | Yes |

| Internet banking : | Yes |

| The Mutual App : | Yes |

| NPP/PayTo/PayID/Osko® : | Yes |

| BPAY® : | Yes |

| Minimum opening balance : | $0 |

| Staff assisted transactions : | Branch and contact centre |

| Document or Information | View or Download |

| Fees, charges and limits | Download PDF → |

| Target market determinations | Learn more → |

| Interest rates | Learn more → |

| Important documents | Learn more → |

| Compare all everyday accounts | Compare now → |

As an authorised deposit-taking institution, deposits with The Mutual Bank are protected by the Australian Government’s Financial Claims Scheme (FCS).

The FCS provides protection to deposit-holders with Australian incorporated banks, building societies and credit unions (known as authorised deposit-taking institutions or ADIs), and general insurance policyholders and claimants, in the unlikely event that one of these financial institutions fails.

The FCS, which has also been referred to as the Australian Government deposit guarantee, is a government-backed safety net for deposits of up to $250,000 per account holder per ADI. It enables account holders’ quick access to deposits that are protected under the FCS.

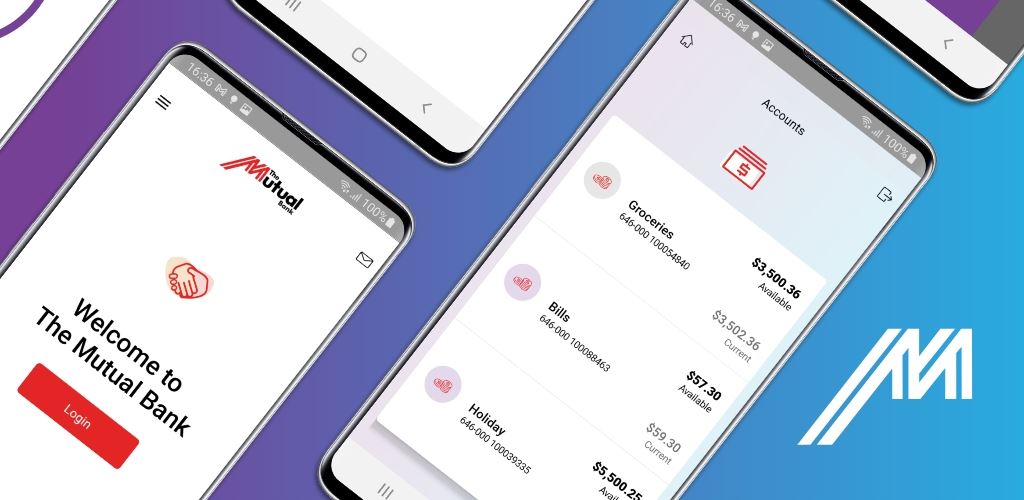

Yes. Once you are registered for Internet Banking you can use your smart device to access your banking. The Mutual App is available to download in the App Store or Google Play. You can transfer money between your own accounts instantly, make BPAY and OSKO payments, set up savings goals and track your spending across expense categories – and so much more.

Please contact us if you would like to arrange a Visa Debit Card with your account.

Our Visa Debit Card allows you to use your Everyday Account at ATMs, online and anywhere in the world Visa is accepted. Our Visa Debit Card is made of plants, not plastic with features that are sustainable and accessible.

We make it simple for you to switch to our Everyday Account. We can organise to transfer your incoming payments (such as your wages or Centrelink) and any regular payments coming out of your account (such as electricity or gym membership). Talk to our team to do the work for you.

You're gonna love us

The Mutual Bank has been supporting regional communities with trusted banking for over 135 years

We’re proudly customer owned, which means we exist to benefit you. Not external shareholders. Whether you're opening your first account or planning for the future, we’re here with genuine service, great-value products and the kind of care only a mutual can offer.

Looking for something else?

View and compare our Transaction Accounts